New Delhi [India], October 31 (ANI): The U.S. Federal Reserve’s decision to cut the policy rate by 25 basis points in its latest Federal Open Market Committee (FOMC) meeting has slightly reduced the odds of another rate cut in December, according to a report by ICICI Bank.

The report said the decision to cut rates further could be a close call.

The report noted that, “Given Powell’s guidance and the fact that there could be delays in official economic indicators, particularly on the labour market, we think that the odds for a 25bps cut in December has reduced by a degree and the decision to cut the policy rate could be a close call.”

In the latest policy decision, the FOMC lowered the policy rate by 25 basis points on expected lines, bringing the federal funds rate to the 3.75 per cent-4.00 per cent range. Alongside the rate cut, the central bank also announced an end to its quantitative tightening (QT) program.

The rate cut decision, however, was not unanimous. Member Miran voted for a larger 50bps cut, while Schmid preferred to keep rates unchanged.

According to the report, these dovish and hawkish dissents reflect the uncertainty about the economic outlook as the central bank continues to balance risks on both sides of its mandate — growth and inflation.

The policy statement was largely unchanged from the previous meeting but mentioned that the ongoing U.S. government shutdown is limiting the release of key economic indicators.

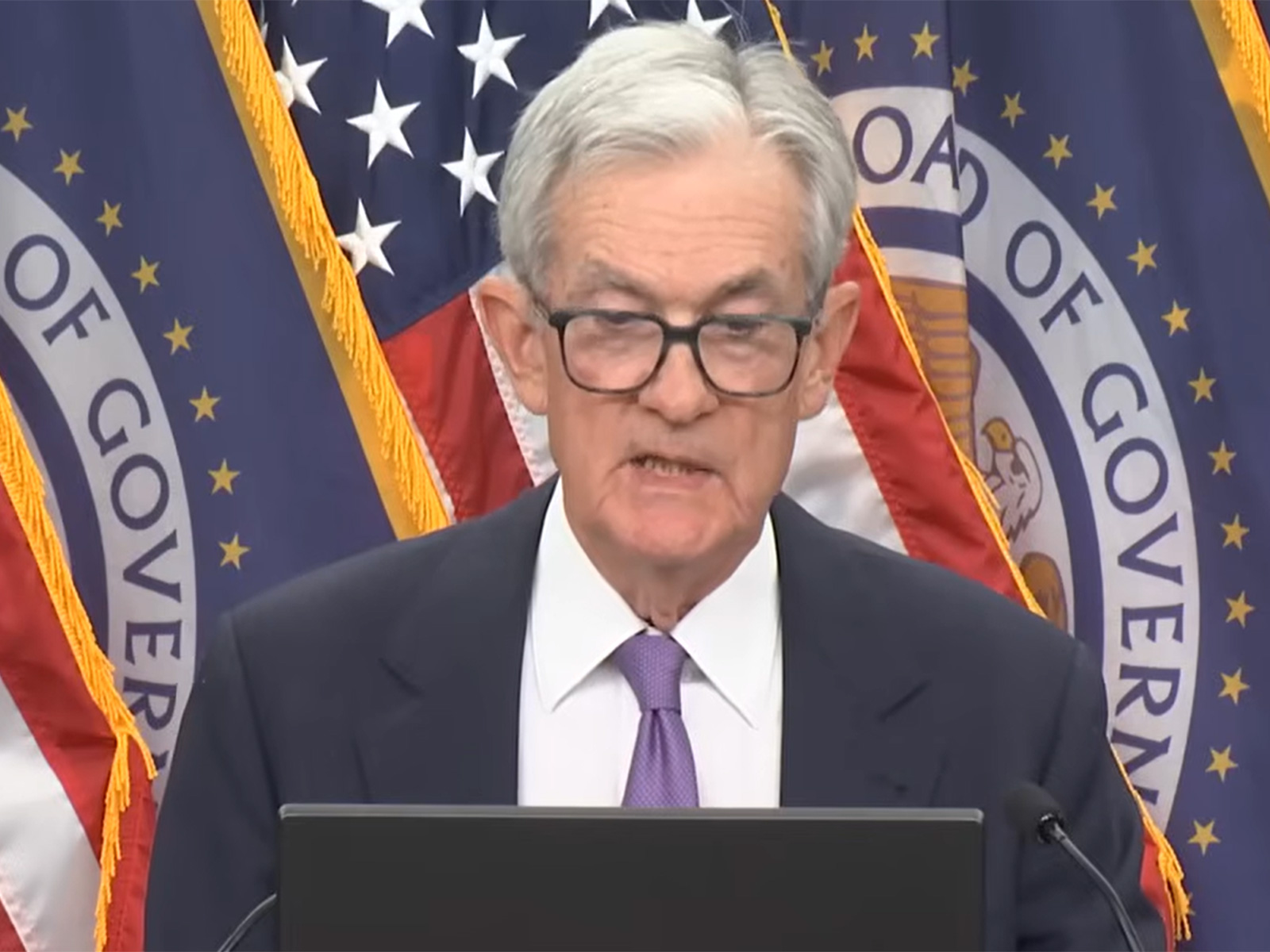

The main surprise of the meeting came from Fed Chair Jerome Powell’s hawkish guidance, as he downplayed the likelihood of another rate cut in December.

Powell stated that there had been no significant deterioration in the labour market since the last policy meeting, while acknowledging that inflation remains elevated.

He also pointed out the challenges in assessing the economic situation during the government shutdown, given the lack of major data releases, which could constrain future policy decisions.

The report maintained its forecast of a further cumulative 75bps cut through the remainder of 2025 and 2026, leading to a terminal rate of 3.00 per cent-3.25 per cent. However, it cautioned that the risks to this projection are tilted to the upside.

With no fresh economic projections or dot plot released this time, the report said market expectations were guided primarily by Powell’s comments and the hawkish dissent within the committee.

Consequently, the bar for another rate cut in December appears higher than previously assumed, especially if the government shutdown continues to restrict the flow of economic data.

Before the meeting, fed funds futures had fully priced in a 25bps cut in December 2025, but the probability has now dropped to around 70 per cent.

The report concluded that a December rate cut remains possible but is likely to be a much closer call than earlier anticipated. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages