NewsVoir

Bengaluru (Karnataka) [India], November 12: India’s financial sector continues to evolve with structural shifts across technology, policy, demographics, and social behaviour. These long-term trends, often referred to as megatrends, are reshaping how individuals save, borrow, spend, and invest.

Investors looking to participate in this evolving landscape may consider exploring the Banking, Financial Services and Insurance (BFSI) sector through suitable options such as the Bajaj Finserv Banking and Financial Services Fund.

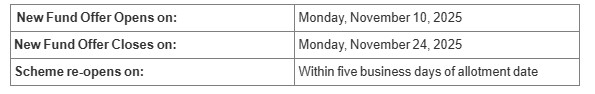

The Bajaj Finserv Banking and Financial Services Fund New Fund Offer opens on Monday, November 10, 2025, and closes on Monday, November 24, 2025. The scheme reopens for subscription within five business days from the date of allotment.

Understanding the Banking and Financial Services sector

The BFS sector includes banks, non-banking financial companies (NBFCs), insurance providers, fintech firms, and capital market participants that facilitate the movement of money and credit in the economy. Supported by ongoing reforms and digital innovation, the sector continues to evolve, broadening access and participation across customer segments.

Technology: UPI and digital payments transforming financial transactions

India’s digital transformation is redefining how transactions take place. Non-cash transactions for Indian households are projected to increase from 38% in FY23 to 62% in FY28. Tier 2 and smaller cities are expected to drive over 80% of the estimated USD 60 billion in digital lending disbursements by FY28.

Fintech innovations are reshaping how payments, lending, and investments are delivered, creating opportunities for companies that enable this digital shift. Funds identifying such businesses may help investors participate in the potential long-term growth of India’s financial digitalisation.

Source: Mobikwik RHP, Redseer, Internal

Economic: Financial inclusion through Jan Dhan expansion

Financial inclusion continues to be an area of focus for policymakers. The number of Jan Dhan accounts has risen nearly 18 times, from 33 million in FY14 to 540 million in FY24, mobilising deposits of around Rs. 2.3 trillion. These accounts have also supported the direct transfer of benefits to citizens, improving efficiency in welfare delivery.

The expanding formal banking base supports higher deposit mobilisation and credit penetration, key enablers for the BFS sector. The Bajaj Finserv Banking and Financial Services Fund seeks opportunities in such areas where structural and policy tailwinds align with business growth.

Sources: Reserve Bank of India, Periodic Labour Force Survey (2023), GSMA (2023)

Demographic: A growing working-age population and rising prosperity

India’s young workforce continues to influence consumption and savings patterns. A larger share of households is entering middle- and high-income categories, with projections suggesting that nearly 75% may fall within these groups by 2030.

This expanding income base is expected to drive higher adoption of credit, insurance, and investment products. The Bajaj Finserv Banking and Financial Services Fund looks to identify businesses that may benefit from these evolving demographic trends.

Source: Jefferies

Social: Fintech innovation expanding access to credit

Fintech firms are playing a growing role in expanding access to credit, particularly among first-time borrowers and small enterprises. Using technology and alternative data, they are helping to reach underserved segments, including women entrepreneurs and rural borrowers.

As new business models emerge in response to changing consumer preferences, the BFS sector may see continued diversification and innovation. Through research-driven selection, the Bajaj Finserv Banking and Financial Services Fund aims to identify companies positioned to benefit from such transitions.

Conclusion

Technology, economic inclusion, demographic expansion, and social innovation are reshaping India’s financial landscape. These megatrends may continue to create opportunities for businesses across the BFS spectrum. Investors seeking exposure to this evolving segment may explore the Bajaj Finserv Banking and Financial Services Fund, which seeks to participate in opportunities arising from these structural developments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by NewsVoir. ANI will not be responsible in any way for the content of the same)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages